After completing this reading, you should be able to:

A contingency funding plan (CFP) is a liquidity management tool that links the stress test results and other related information as inputs to the CFP governance, decision framework, and menu of contingent liquidity actions.

Institutions manage low-impact and high-probability events as part of their business-as-usual (BAU) funding and liquidity risk management activities. On the other end, they use CFPs to address high-impact low-probability events. Institutions use CFPs to develop and implement their financial and operational strategies for effective management of contingent liquidity events.

While smaller institutions have included CFPs as part of their broader business continuity plans, larger institutions have created more formal CFPs. There is no universality related to establishing CFPs. However, firms should consider the following factors when designing or refreshing their CFPs.

Institutions can develop their CFPs using an integrated framework that addresses people, process, data, and reporting dimensions, deliberating the critical design considerations discussed in the previous session. They should customize their CFP framework to their business and risk profiles.

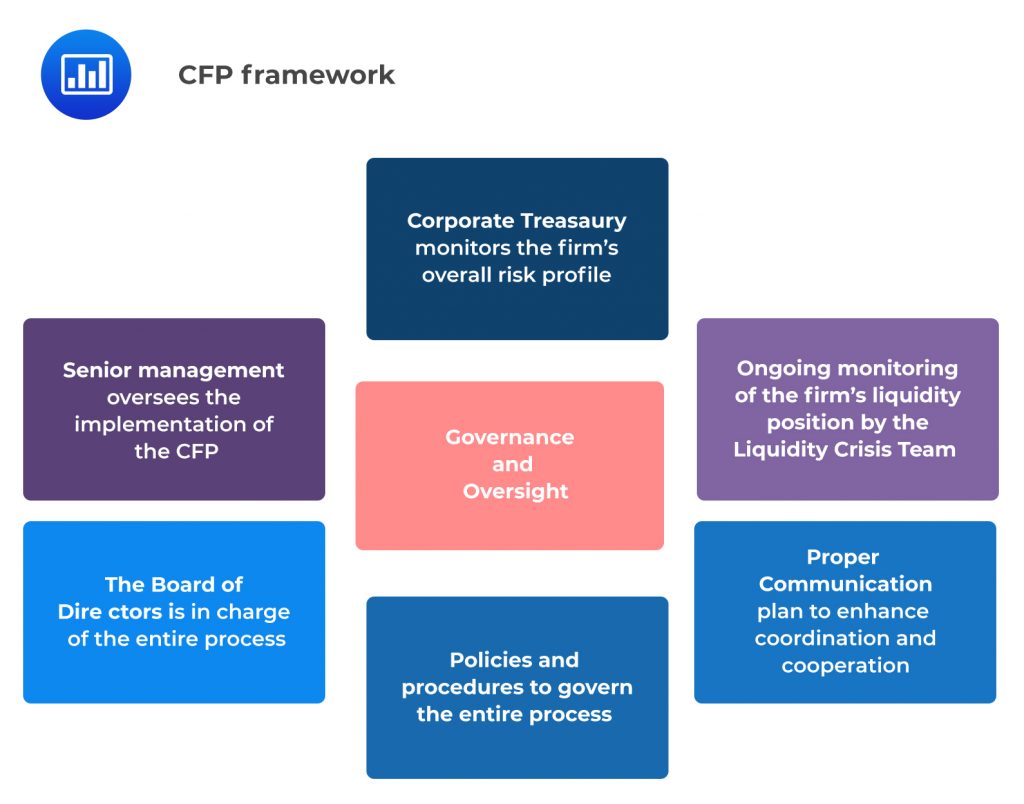

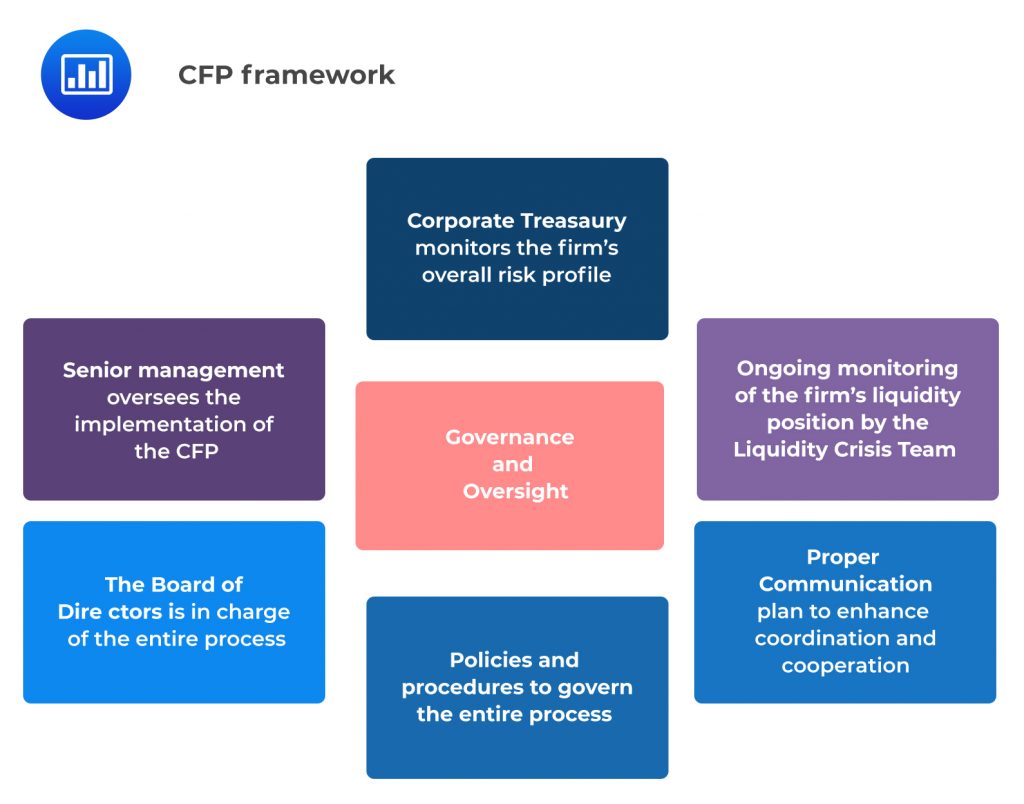

The major components of a CFP framework include the following:

To develop a valid CFP, an institution should come up with well-defined roles and responsibilities, as well as a robust communication strategy that provides timely coordination and communication among internal and external stakeholders. The organizational roles and communications plan should be justified by well-defined policies and procedures and reinforced through CFP periodic testing and simulation exercises.

Corporate treasury, management committee, liquidity crisis team, and board of directors have critical roles in CFP design and implementation. The following descriptions should be the starting point for institutions in defining specific CFP roles and responsibilities. These roles should be adjusted to suit the organizational structure, capabilities, and coverage/responsibilities of the institution:

The treasury monitors the ongoing business, funding, risk, and liquidity profile as part of its BAU activities. The treasury can consult the CFO and others to invoke the CFP and convene the liquidity crisis team (LCT) regarding a review of the markets, and liquidity stress testing results, among others.

Liquidity Crisis Team (LCT)

The LCT undertakes continuous monitoring of the institution’s liquidity profile. Moreover, it provides recommendations on CFP actions, designs the CFP, and submits it to the senior management for review and approval. The LCT members include senior members of the institution’s business and supporting functions, geographies, and legal entities.

The senior management oversees the LCT and does a consultation with the board of directors to monitor the institution’s liquidity risk profile and review specified recommendations for the coordination of the CFP actions during a crisis.

Board of Directors

During a financial crisis, the board of directors serves as an advisor and counsel to the management committee and the Liquidity Crisis Team (LCT).

In CFP, a communication strategy and plan are essential to ensure enough notification, coordination, issue reporting, and escalation. The various groups across the institution should work in concert, relying on each other to ensure information is available on time to support management decision-making.

In any crisis, transparent and timely communication helps the institution to demonstrate a sense of control and confidence that management understands future challenges and has a plan of action.

Coordination points can vary across institutions, depending on their size, complexity, and organizational structure. The following is an example of such coordination:

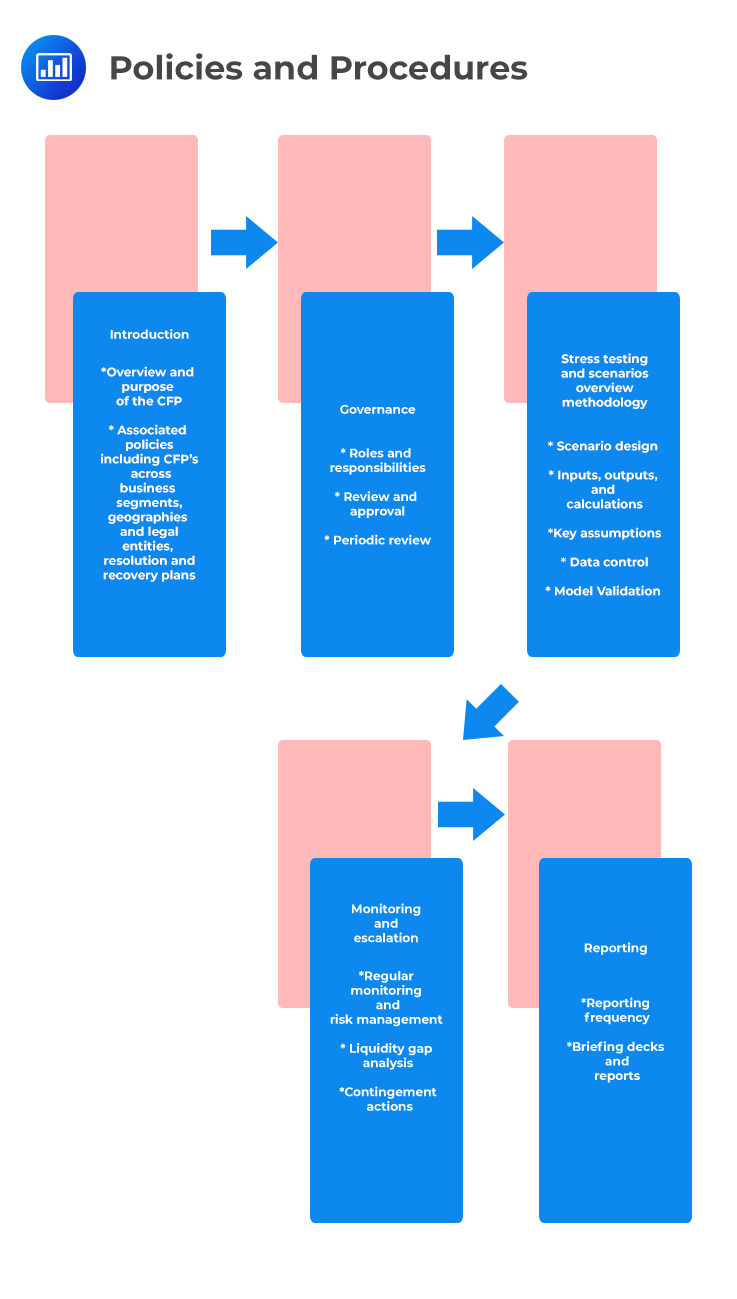

Policies and Procedures

Institutions should endeavor to document their CFPs. Documentation should capture all aspects of the CFP, including the governance structure, processes, data, and reporting activities. A CFP policy outline may look like this:

The systemic and idiosyncratic nature and amount of the stress events significantly influence the availability and the potential impact of the above contingent events. Deposit runoffs, an increase in the cost of funding, and cash deposit requirements are among the market factors that can impact an institution’s ability to take contingent actions.

The management should try to predict these challenges hand in hand with the effects they may pose on its liquidity responses. CFP should also document alleviating actions that management would consider taking to address such challenges.